Electronic W-2 Filing

The 2025 E-Filing utility is available for download below.

Instructions:

Ready to file your W-2 files online? Let's get started!

How it works in EBMS: A separate file is created for the Social Security Administration (SSA) and for each state that has a match in File > Company Information [Advanced].

Registration is needed if it is the first time your company is filing W-2's electronically with the SSA. If this has not been done already it is too late to file electronically this year. Please register anytime so you can do so next year.

Federal: The SSA requires employers with over 10 employees to file W-2's electronically. Those under 10 employees are also encouraged to make use of those services.

State: State filing requirements vary and may be more stringent. For example, in PA employers with over 10 employees are required to file electronically.

Print: If you are not filing electronically for federal, state, or both, print all pre-printed and plain paper forms from EBMS.

Regarding 2025 tax deductible overtime- Due to recent changes in payroll tax law, a portion of paid overtime is now tax deductible. There are no requirements to add this information to 2025 W-2s, but we have added a report with the required information that we recommend you provide for each employee along with their W-2. You will find the report in the EBMS reports menu at File>Reports>Labor>Year End>Worker Overtime Tax Deduction Calculator.

Please reach out to your CPA if you have any questions regarding tax code changes.

Follow these instructions to file W-2's electronically:

Step 1: Register at the SSA

Registration is needed if it is the first time your company is filing W-2's electronically with the SSA. If this has not been done already, it is too late to file electronically for the 25/26 tax year. Register at the Social Security website so you can file electronically next year.

If you filed electronically in a previous year simply confirm that you are able to log in and then continue to step 2.

Step 2: Run the EBMS W-2 Export Utility

A) Download the W-2 Export File

Click on the link below to download the W-2 Export File

Download W-2 Export File

Download W-2 Export File

B) Run the File

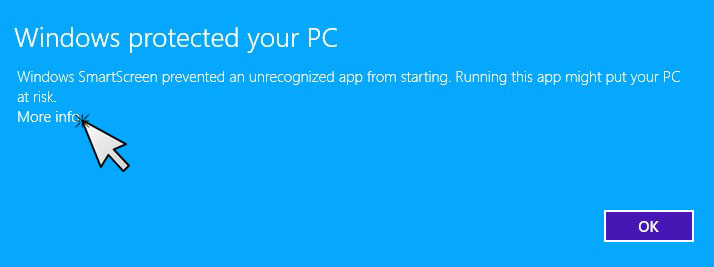

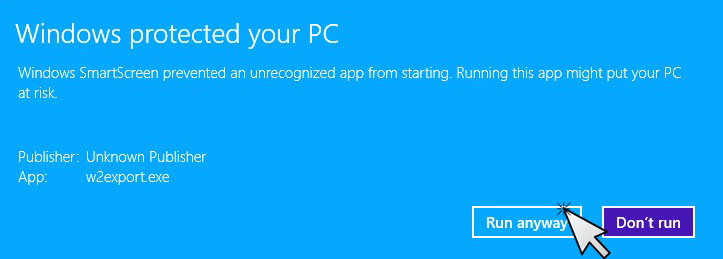

You may receive a Windows protected your PC message. Please click on More Info below the message and select Run Anyway. After double-checking the information, choose Allow or Run or Open to continue the process. If you have an anti-virus program running, it may warn you that a malicious script has been detected. Choose to Allow/Authorize this Script.

Depending on the Operating System and Anti-Virus program of your computer you will need to specifically allow the file to run.

C) Follow the instructions on the utility in EBMS

- W-2 File Path: Select a folder on your computer where you want the W2 file to be stored. The utility will automatically insert the name of the file. (W2Info)

- The filing year should be 2025.

- Resubmission info is blank for original filing

- Select a preferred method of receiving communication back from the SSA

- Enter your Submitter PIN that was assigned to you on registration in step 1 in the User ID field.

- Enter submitting information:

If you are filing for you own company: the Submitting Company, Employer Info, and Submitter Info will be the same.

If you are an accountant or third-party filing: change the submitter info (the second one on the right) to your own information.

NOTE: The submitter PIN will need match the Name under the Submitter info. These details are defaulted from the Company Information where possible – verify that the information is correct and select OK.

- If there are invalid formats entered on EIN or SS numbers, it will ask for a correction. If the employee does not have a social security number, enter 000-00-0000. Please note: this does not verify the validity of the social security number, it only checks standard formatting.

- A W-2 Verification Page is displayed. This is for you to double-check what is being submitted.

- A W-3 form is not needed when filing electronically. The W-3 information is uploaded in this same file.

Step 3: Verify and Submit to SSA

A) Locate the file saved on your computer in step 3C.

Example: C:\EBMS\W2Info

B) Run file through SSA AccuWage

It is recommended that you run the file through the AccuWage software online before submitting to the SSA. AccuWage verifies that you are submitting the correct file and that there aren't errors to correct before submitting. The SSA AccuWage software is available online after logging into the Business Services portal

C) Submit File to SSA

Return to SSA’s Business Services Online (BSO) to submit the electronic file.

Step 4: Submit W-2's to State and Local

A) Check with your state and local agencies for electronic filing requirements. State filing requirements vary and may be more stringent. For example, when filing in PA employers with over 10 employees are required to file electronically. If you decide not to file electronically continue to step 5.

B) Locate the State W-2 file created in Step 2C on your computer. A file was created for each state that has a match in EBMS > File > Company Information [Advanced].

C) Submit file to State and/or Local Agency

This varies based on your location. Check with your state or agency for details.

Step 5: Print W-2 Forms

For local and state agencies not filed electronically: EBMS has the ability print all plain paper W-2 forms. Requirements vary from agency to agency. The employer copies submitted to the various agencies and for yourself do not normally need to be on perforated paper.

For Employees: Two pages (a total of 6 W-2's) should be printed for each employee. The employee form is required to be printed on perforated paper with three on a page. Click here to order forms from Koble

To print W-2's for each employee go to: EBMS > File > Reports > Labor > Year End > Form W-2 (Plain Paper) - Employee Copies.

> View Step-by-Step Instructions

Contact the support team or visit or Year End page for more information.

Sincerely,

The Koble Support Team

mytickets@koblesystems.com

717-442-3247 x2