Complete these steps to prepare for payroll year 2022.

*Note that this applies only to those using the EBMS Payroll Module

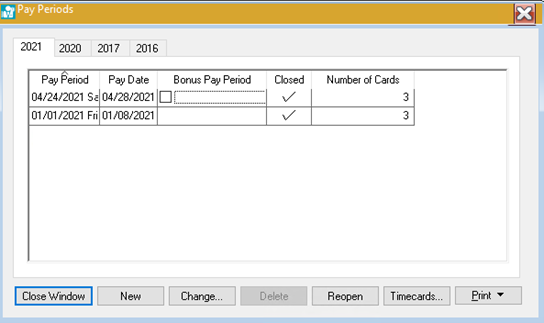

1. Create and process any bonus periods you want to have expensed in 2021 (any bonus pay period with a 2021 pay date).2. Ensure that all pay periods that have a 2021 pay date are completed and closed.

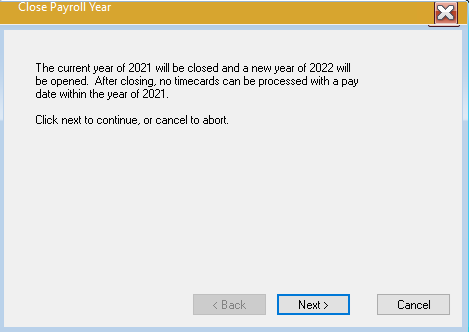

3. Close payroll year 2021 and open payroll year 2022 (Labor > Close Payroll Year)

4. Bookmark the EBMS Support Year End Page and check regularly for any payroll tax updates.

The 2022 tax update may not be available until close to the New Year depending on when thet are released from the IRS. It is important to have your taxes updated before the first pay date of the new year if possible.

5. Print out the EBMS Payroll Checklist for a complete list of payroll year-end processes.

Did you order your tax forms yet? Buy them on our website before 12/31/21 to get FREE SHIPPING.

Please feel free to contact the client support team if you have any questions or visit the Year End web page